There are several automatic responses to “poor people” from a large swath of society: pity, sadness, fear, elitism, and often revulsion.

It could be argued that most, if not all, of these reactions could stem from misrepresentation and misunderstanding. But first and foremost, “poor” does not mean “stupid.”

It’s probably fair to say that many people had less than optimal upbringings where the lessons on handling money were limited to statements like, “We can’t afford that” and, “If you want something, you’ll have to save up for it.” But basic financial literacy is not a topic one would find in most classrooms.

“Another reason for the lack of financial education in schools is that education decisions are made on a state level, so there’s no federal mandate or guideline to help schools learn the most effective approach to teaching personal finance.” ~ Grant Eckert

Like most everything else for the poor experience, it’s a lack of opportunity rather than a lack of intelligence. If you asked a high-school student if they had a choice between learning basic money skills or taking on tens of thousands in debt throughout their adult lives, they’d probably pick the former, boring as it may sound.

The Two Realities of Being Poor

First, most people who live below the poverty line are behind the eight ball almost always. They must overcome odds that the wealthy just have no concept of:

>> Living in an economically depressed area

>> Underfinanced and overcrowded schools

>> Un- or underemployed for minimum/low wages

>> Come from a lineage of impoverished living

>> Social safety net programs are overutilized and underfunded

When given the choice between making a little money or no money, the poor frequently have to take the low wages, forcing them to remain in the cycle of never being able to accumulate savings, let alone wealth.

Imagine being born “in debt” and interest is accruing daily. In a study done by Dartmouth College in 2016…

“…children with parents that had either higher levels of or increases in unsecured debt (credit card or other types of debt that is not tied to an asset, such as medical debt and payday loans) were likely to experience poorer socioemotional well-being.”

Not only do you have to advance beyond your family’s debts, but you’ll likely have to then defeat your own. You have grown up learning that payday loans and food stamps are a part of life. This is not stupidity; it’s starting with a huge disadvantage.

Secondly, poor people are some of the cleverest people I have ever met. They can make a dollar stretch around the damn block! They are not afraid to eat beans and rice for a month, take on more work, or put on a sweatshirt instead of turning up the heat. They tend to be pretty amazing cooks as well and know how to cook from scratch, turning a few vegetables into a big pot of soup or stew that will last a week.

And recycling and upcycling? Psssh…these folks are the models we should emulate. Waste is a bad thing, and they will use something until it disintegrates and it’s “just fine.” They’re not lazy or unwilling, they just have far less to choose from and they make the best out of all of it.

Leveling the Playing Field

Blah blah blah. This phrase has been used ad nauseam. Study after study after study has been done to find out why poverty exists. We all have our own opinions on this, and many are true, which adds to the complexity of the situation. To name a few:

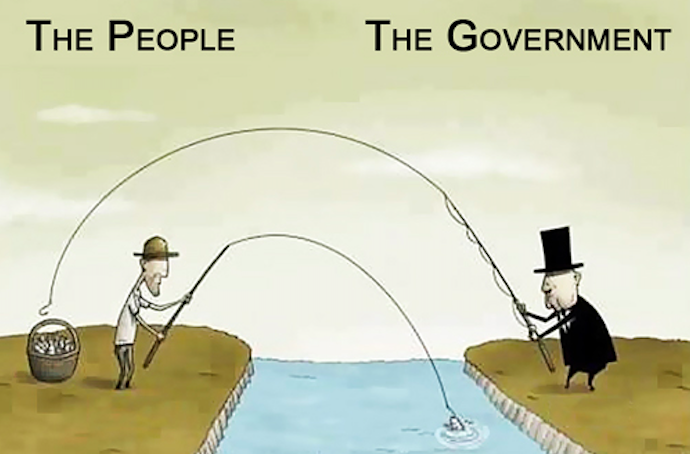

>> Capitalism—my personal favorite. When people are used as human staircases to achieve mega-profits, the likes of which can’t even be spent in one’s lifetime, it’s plain wrong.

>> Wealthy legislators making laws for situations they have never experienced. To be (cough) fair, they don’t know what they don’t know. $600 is lunch to them. If the 50th most wealthy Congressperson is worth $7 million, there’s a problem.

Here’s a plot twist…the “poorest” on the list (Senate and House in 2018) has a negative net worth of $17 million. So, it begs the question: How do you have a negative $17 million net worth and still have a job in Congress? Or any job? Why aren’t they on the street corner with a cardboard sign?

>> Raising minimum wages to a living wage and eliminating “tipped” wages. (My next article.)

>> Better labor laws that protect workers. No more “exempt and non-exempt.”

>> (Much) better social safety nets, fully funded and liberally distributed.

>> Making laws truly.

Though it gives me great pain to agree with Representative Lauren Boebert, this one statement she made rings true.

“I wish more members of Congress had the life experiences that I’ve had.”

She and others like Alexandria Ocasio-Cortez, for example, who have been “working stiffs” in regular America don’t have as much voice in Congress though they are the vast majority. Sadly, I believe Boebert is going about it the wrong way. It takes a lot of chutzpah to jump in the ring with all those rich people, but more than that—it takes a lot of M.O.N.E.Y. Raising funds without the connections the one-percenters have is pretty difficult, but AOC proved it can be done.

Real Live Equal Opportunity

We need more than words. We must find a way to do away with things like racial and gender profiling (read: no more of these questions on job applications) and hire based on true qualifications. Programs like “Affirmative Action” had the right idea, but don’t really work in practice. The myth of the “welfare queens” must be dispelled. The poor know they’re poor. And the sheer act of surmounting the stigma and shame associated with it is mind-boggling.

We must help lift up those at a disadvantage to hear their experiences, learn what truly would help, and enjoy the beautiful diversity we have in America.

~

Read 1 comment and reply