Going from high school to college is a major transition in a teenager’s life, but it’s not just the student that is affected by this change. College can impact the entire family’s finances and lead to significant money challenges that everyone must overcome. Here’s a look at three financial obstacles families will face when preparing to send a child to college:

Paying For Tuition

Students have to pay a pretty penny in order to attend college after high school. It’s estimated that the average annual cost of tuition for a public four-year university is $9,410 for in-state students and $23,890 for out-of-state students. If your child is planning on attending a private school, the average annual cost jumps to $32,410.

Some parents choose to help their children pay for their college tuition. Although this is a generous offer, it can put a strain on the family’s finances. Students also have the option of applying for scholarships, however there’s no guarantee that they will be awarded enough to cover the cost of their tuition.

It’s also possible to secure a student loan to pay for tuition. If your child is planning on securing a loan, it’s important to run a credit report prior to meeting with lenders. Many teenagers have low credit scores because they have not had time to build their credit up yet, which makes getting approved for a loan much harder. Fortunately, there are many financial institutions that offer student loans to people with bad credit, so this could still be an option even if your child has a low credit score.

Supporting Two Separate Households

Parents often financially support their children throughout their college years. If you are planning on helping your child cover living expenses, it’s important to prepare for this major money challenge. Parents who choose to help their children will basically be financially responsible for two separate households, which means you may need to budget for twice as much for electric, water, and other monthly expenses. If you aren’t prepared for this increase in monthly expenses, the decision to provide financial support to your child could cripple your family’s finances.

Adjusting to Financial Freedom

College-bound kids must also learn to adjust to financial freedom. Regardless of whether kids are paying for their living expenses on their own or getting help from their parents, they will need to learn how to budget their money for the first time. Kids who have never been in control of money before may have a few slip-ups. For example, your child may not have money for groceries by the end of the month if he spent far too much in the first few weeks. Learning how to budget is an important lesson that kids learn outside of the classrooms in college. But, it can take awhile for kids to get the hang of it, so parents may need to step in and help from time-to-time.

This is an exciting time for both parents and college-bound kids. By preparing for these financial obstacles, families can focus on celebrating their loved one’s journey to college instead of worrying about their finances.

Browse Front PageShare Your IdeaComments

Read Elephant’s Best Articles of the Week here.

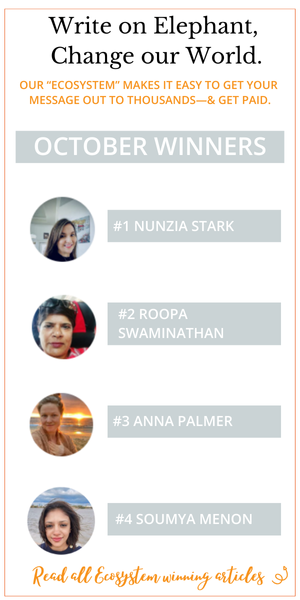

Readers voted with your hearts, comments, views, and shares:

Click here to see which Writers & Issues Won.